Start Here

Start Here

Let's Simplify Your Finances: A Step-by-Step Guide

Step One:

Track Your Money

Use a Simple Spreadsheet: Create a basic spreadsheet with columns for date, category, description, and amount.

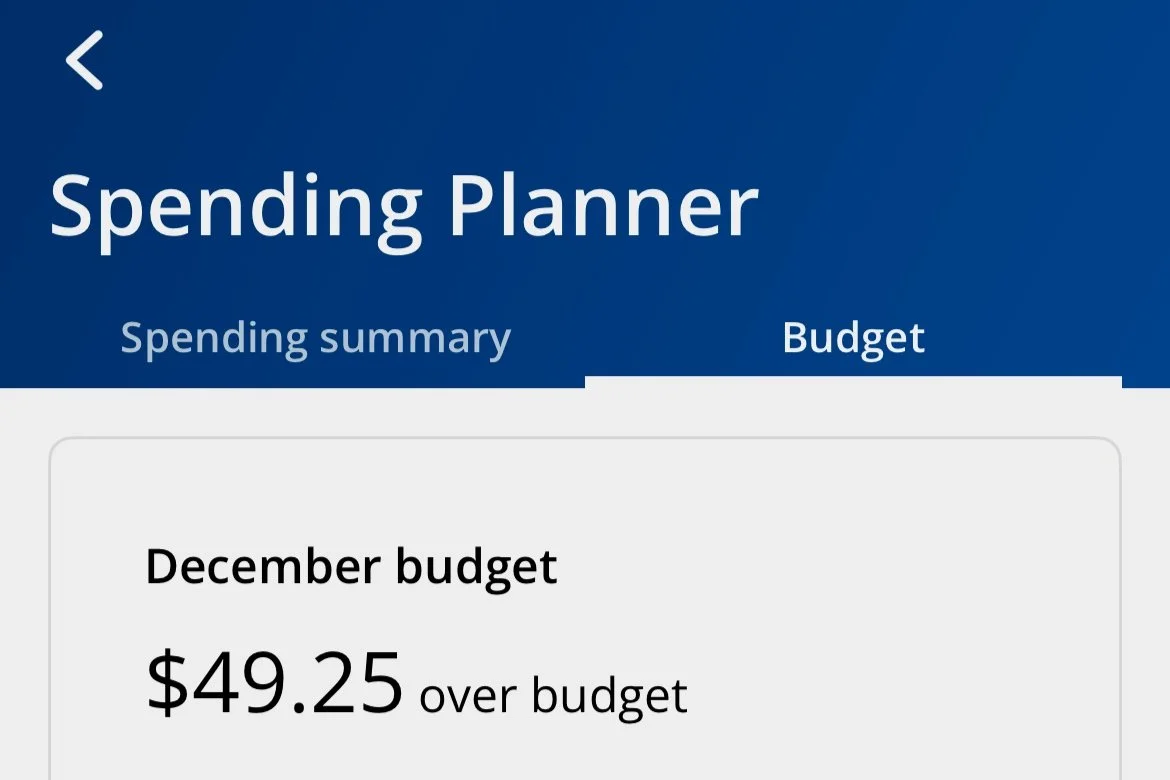

Leverage Your Bank's Tools: Many banks offer online tools and apps to track your spending. Chase's Spending Planner is a great example.

Categorize Your Spending: Divide your spending into categories like:

Needs: Rent, utilities, groceries, transportation

Wants: Dining out, entertainment, shopping

Step Two

Create a Budget

Estimate Your Income: Consider your monthly salary, any side income, and other sources of money.

Allocate Your Spending: Assign a budget for each subcategory based on your income and goals and categories them by major categories.

Review and Adjust: Regularly review your budget and make adjustments as needed. I typically set a budget at the beginning of the year.

Click here for my budgeting template

Step Three

Set Financial Goals

Short-Term Goals (6 months):

Save for a vacation

Pay off a small debt

Medium-Term Goals (1 year):

Build an emergency fund

Save for a down payment on a car

Long-Term Goals (3 years):

Buy a house

Save for retirement

Tips for Success:

Start Small: Begin with a simple budget and gradually add more detail as you get comfortable.

Be Realistic: Set achievable goals and avoid overly strict budgets.

Track Your Progress: Regularly review your budget and make adjustments as needed. I would recommend start tracking your spending on a monthly basis.

Celebrate Your Wins: Reward yourself for achieving your financial goals.